Digital asset management Manage and distribute assets, and see how they perform.Resource management Find the best project team and forecast resourcing needs.Intelligent workflows Automate business processes across systems.Governance & administration Configure and manage global controls and settings.Streamlined business apps Build easy-to-navigate business apps in minutes.Integrations Work smarter and more efficiently by sharing information across platforms.

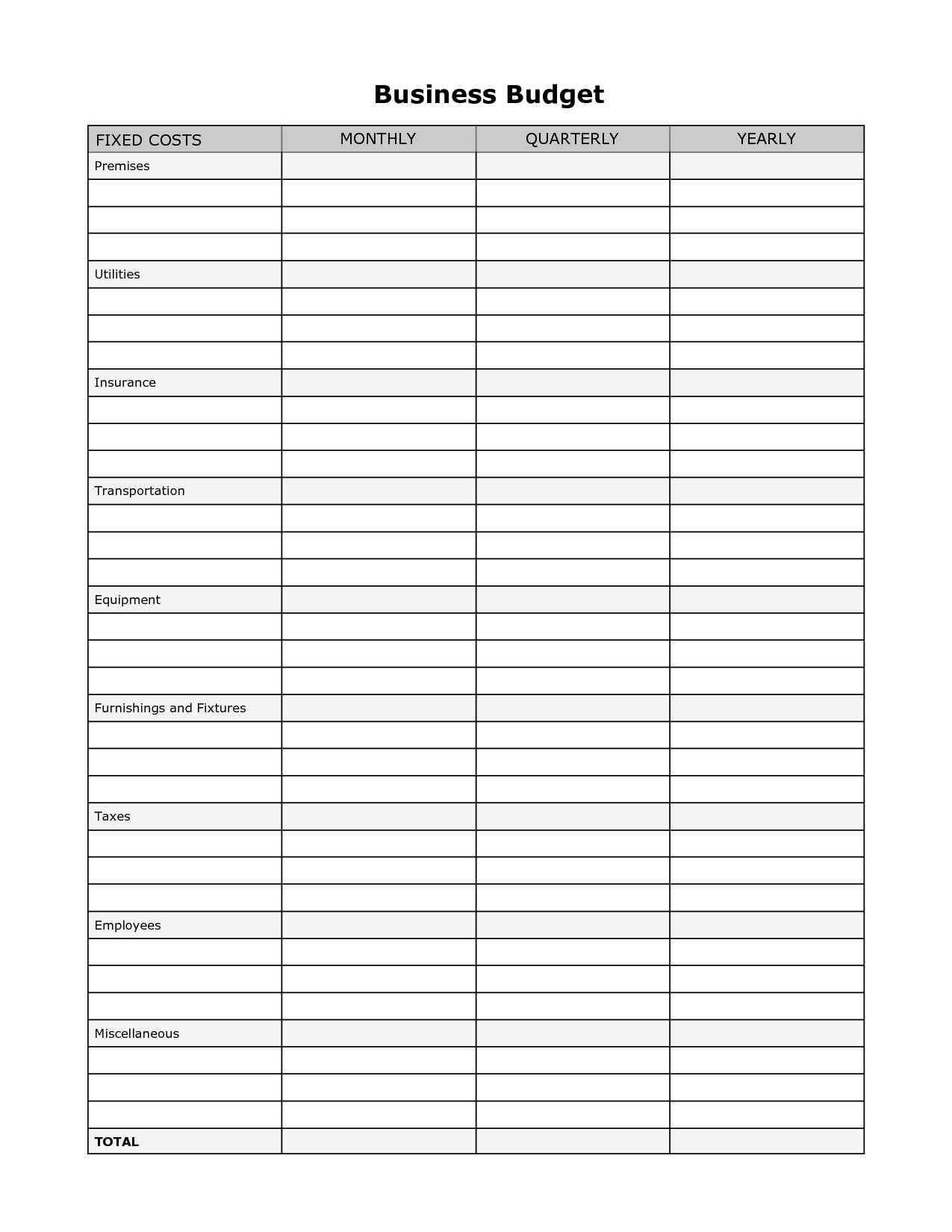

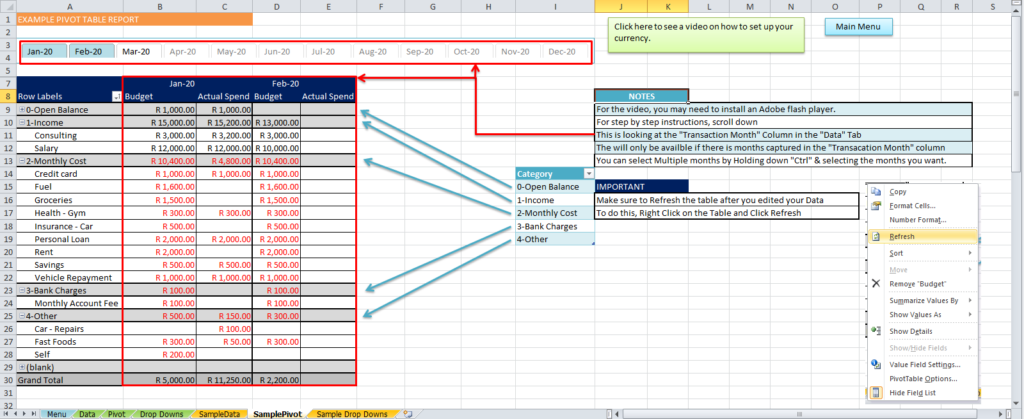

Secure request management Streamline requests, process ticketing, and more.Process management at scale Deliver consistent projects and processes at scale.I find that it is a bit pointless to track every transaction you make but rather just combining them by category at the end of the month. A monthly budget is a plan for how you will spend your money each month. It is not something that makes you list all your transactions on a granular level however. Content management Organize, manage, and review content production. The monthly expenses spreadsheet I created focuses on budgeting by breaking out the spending into numerous categories.Make sure you include all your expenses, for example money you spend. Workflow automation Quickly automate repetitive tasks and processes. debit and credit card statements or bills receipts for things you usually pay for in cash.Team collaboration Connect everyone on one collaborative platform.Ensure you’re only entering amounts not already deducted from your paycheck. Expenses could be based on past spending habits you gather from account statements or your spending tracker. There, enter your budgeted amount for each category in Projected. Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale. Monthly Expenses Calculator Click on the Monthly Expenses Calculator tab.If you’re confused about whether something is a need or a want, simply ask yourself, “Could I live without this?” If the answer is yes, that’s probably a want. It simply means being more conscious about your money by finding areas in your budget where you’re needlessly overspending. And if you discover that you’re spending too much on your wants, it’s worth thinking about which of those you could cut back on.Īs a side note, following the 50/30/20 rule doesn’t mean not being able to enjoy your life. Using the same example as above, if your monthly after-tax income is €2000, you can spend €600 for your wants. Entertainment subscriptions (Netflix, HBO, Amazon Prime).

Wants are defined as non-essential expenses-things that you choose to spend your money on, although you could live without them if you had to. With 50% of your after-tax income taking care of your most basic needs, 30% of your after-tax income can be used to cover your wants.

0 kommentar(er)

0 kommentar(er)