You may need a copy of your tax return in the event you need to prepare for a tax audit. Generally, the IRS makes tax return copies available for seven years from the original date they are filed before they are destroyed by law.

LAST YEAR TAX RETURN PROFESSIONAL

Archived returns for Tax Year 2014 can be obtained for $43.00 per copy since these cannot be obtained from the IRS. In comparison, the IRS charges $43.00/per return copy for any return, no matter what year.Īfter October 17, 2022, Archived returns for tax years 2015-2019 can be obtained for $9.95 per copy. contact an eFile Taxpert ® for archived return copies which can be obtained at $9.95/per return copy. If you need an older return you filed with. Tax returns prior to these years are archived and, if you filed these returns with, they can be obtained via your Personal Support Page. Your current tax year and two previous year’s returns are kept in your current account free of charge to you. We recommend downloading a copy of your return right after you e-file it, this way you do not forget and you have the same copy that is sent to the IRS.

LAST YEAR TAX RETURN PDF

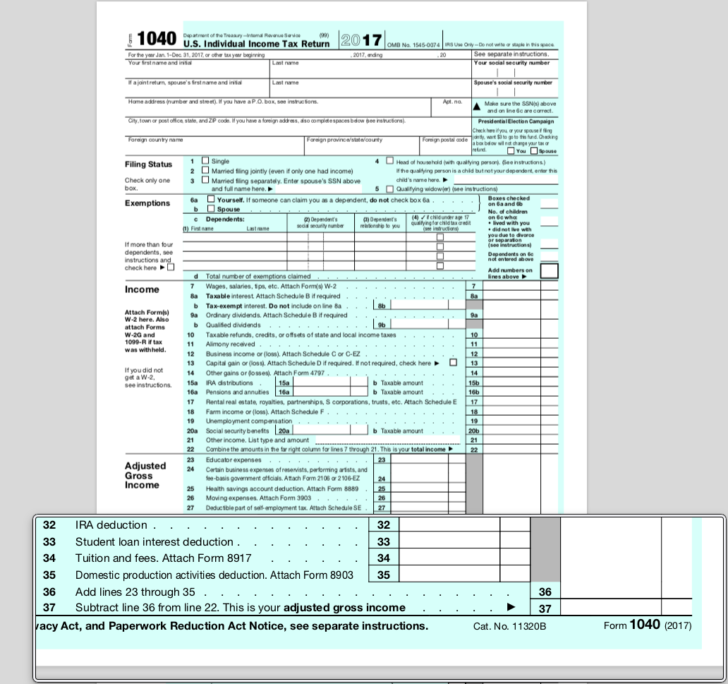

Your completed return will be listed as a PDF file, ready for you to download and print. Click the appropriate tax year link under the "Your Return" heading.Note: On a mobile device, click the three dots in the upper-left corner.Click My Account on the upper right side of your account screen.Sign in to your account and follow the instructions below: Your current and previous two returns are stored in your account on. Tax Return Copies for UsersĪs an tax preparer or eFiler, you have the privilege of accessing your previous year tax returns for up to 7 years. The data on an IRS transcript can be used for this if you cannot retrieve a copy of last year's return. Your previous year return is used to e-file as the IRS uses data from it to verify your identity.

LAST YEAR TAX RETURN HOW TO

If you did not file via, see how to get a copy or transcript of your return. While we store your most recent returns, you should download and print a physical copy for your records. Next year, prepare your 2022 Taxes on by the deadline and store all your returns in one account. After this date, you can no longer e-file 2021 Taxes. If you missed the April 18, 2022 Tax Day deadline or e-filed an extension, file your taxes online by October 17, 2022. Plus, users will have access to their Adjusted Gross Income when it is needed to file their taxes. users have access to copies of their tax returns for 7 years.

0 kommentar(er)

0 kommentar(er)